fulton county illinois property tax due dates 2021

The median property tax in illinois is 350700 per year for a home worth the median value of 20220000. Illinois is ranked 893rd of the 3143 counties in the United States in order of the median amount of property taxes collected.

Terms Fulton County Treasurer Il Online Payments

770-278-676 for the Board of Assessors.

. Taxes paid after 10 days are subject to a 10 penalty. City of Gloversville County Property Tax beginning January 1. Box 4203 Carol Stream IL 60197-4203.

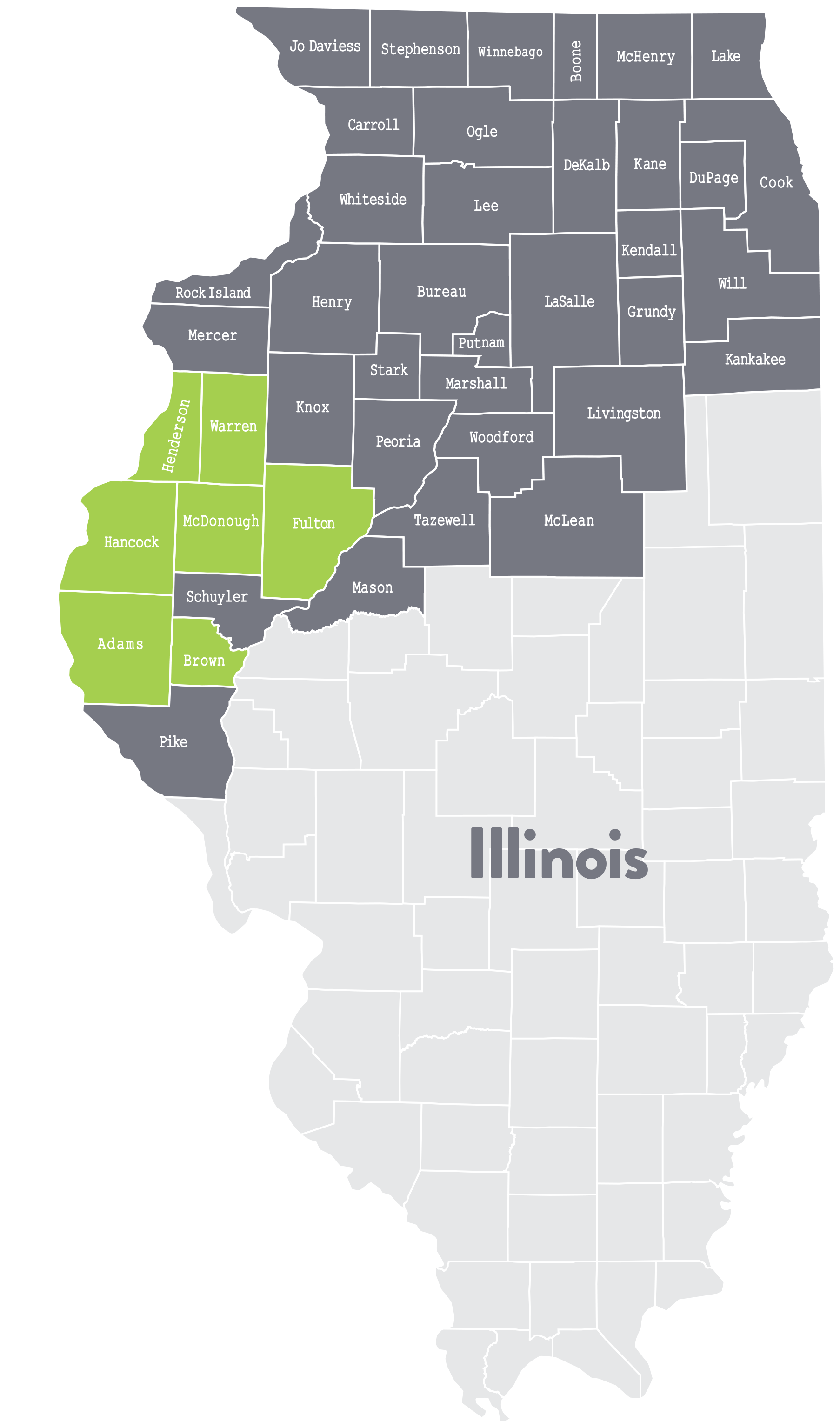

INC3 - CANTON-SOUTH INCREMENT 3. The median property tax in Fulton County Illinois is 1406 per year for a home worth the median value of 79000. Elsewhere a county board may set a due date as late as June 1 The second installment is prepared and mailed by June 30 and is for the balance of taxes due.

In Person Beginning on May 1 2022 pay in person using cash check credit or debit card during our offices normal business hours of Monday - Friday 800 AM - 430 PM. The 2nd half 2021 Real Estate taxes will be due on July 20 th 2022. This installment is mailed by January 31.

Property tax returns must be filed with the county tax office between January 1 and April 1 of each year. Normal collection will resume on may 1. City of Gloversville City Tax beginning December 1.

2022 Property Tax Calendar. Ford County Treasurer. June 4 2021 Published.

Payments are due to Fulton County for property taxes. FULTON COUNTY BOARD OF COMMISSIONERS. Tuesday March 2 2021.

Real estate taxes are generally due on February 5 for the first half billing and July 20 for the second half billing. Young persons may join 4-H at any time of the year but to show at the summer 4-H Shows they must be enrolled at the Extension office in Fulton County by May 1 of each 4-H year. The Fulton County Tax Commissioner is responsible for collecting property taxes on behalf of Fulton County Government two school systems and some city governments.

The deadline to pay property taxes is approaching. The median property tax in Fulton County Illinois is 1406 per year for a home worth the median value of 79000. The Treasurers Office accepts Online Payments for the Following ONLY.

Cook County Il Property Tax Calculator Smartasset Douglas st suite 503 freeport il 61032. County and county school ad valorem taxes are collected by the county tax commissioner. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER.

Forms Documents EXEMPT PROPERTY QUESTIONNAIRE - REVISED 2017 Exemption Questionnaire. IF YOU OWN AND LIVE IN A HOME IN FULTON COUNTY HOMESTEAD EXEMPTIONS MAY HELP REDUCE YOUR PROPERTY TAXES. Pay property tax online in the county of fulton illinois using this service.

On February 5th and on July 20th. Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. In Cook County the first installment is due by March 1.

The 2020 payable 2021 tax bills for Ford County will be mailed May 28th 2021. View Form PT-283A Application for Current Use Assessment of Bona Fide Agricultural Property Application for Current Use Assessment Of Agricultural property PT-283A. Taxes paid within 10 days of the due date are subject to 5 penalty.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Even though the official due date for ad valorem tax payment is December 20th the local governing authority may adopt a resolution changing the official due date for tax payment to December 1st or November 15th or may implement installment billing with. The 1st half 2021 Real Estate taxes are due by February 7 th 2022.

Will County Property Tax Due Dates 2021. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the. HOMESTEAD EXEMPTION DEADLINE - APRIL 1 2021.

Every year homeowners receive their property tax statements by mail. Fulton County collects on average 178 of a propertys assessed fair market value as property tax. APPLY ONLINE AT WWWFULTONASSESSORORG CALL US AT 404-612-6440 X 4.

First Installment due date is July 2nd 2021. Median Property Taxes Mortgage 1948. Tim Brophy Will County treasurer recommended June 3 August 2 and 6 respectively as deadlines for the board.

DuPage County Collector PO. Payments can be made through major credit cards eBilling eChecks Apple Pay and Google Pay. Median Property Taxes No Mortgage 1714.

This page is your source for all of your property tax questions. Property tax payments are made to your county treasurer. The Fulton County 4-H program is open to youth ages 8 to 18 as of September 1.

Fulton County Board of Assessors. By now all Fulton County property owners should have received tax statements by mail. FULTON COUNTY 2021 HOMESTEAD EXEMPTION GUIDE.

Taxpayers who do not pay property taxes by the due date receive a penalty. Real estate taxes are mailed out semi-annually and are always one year in arrears. Gloversville Johnstown beginning Dec 1.

County and county school ad valorem taxes are collected by the county tax commissioner. 2022 Property Tax Calendar. Tax payments for your residential property must be made in two installments.

No payments are accepted during april. Real Estate Tax Due Dates. 2021 re tax due dates.

Fulton County collects on average 178 of a propertys assessed fair market value as property tax. The balance is calculated by subtracting the first installment from the total taxes due for the present year. Lake County Property Tax Appeal Deadlines Due Dates 2021.

2020 - Property Tax Due Dates. If you did not have a valid drivers license for 2021 it would cost 300 on Oct. If the due date falls on a holiday or a weekend the due date will be extended to the next working day.

2022 DEVNET Inc. Beginning May 2 2022 through September 30 2022 payments may also be mailed to. Welcome to Ford County Illinois.

When are property taxes due in fulton county oh. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes.

Fulton County Property Tax Payments Annual Fulton County Illinois. County Code of Ordinances. 191 KB File Size.

The due date and delinquent date depends on when the bill is mailed. The current 4-H year runs from September 1 through August 31. The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other.

Box 4203 Carol Stream IL 60197-4203. Please contact the office if you dont receive a bill.

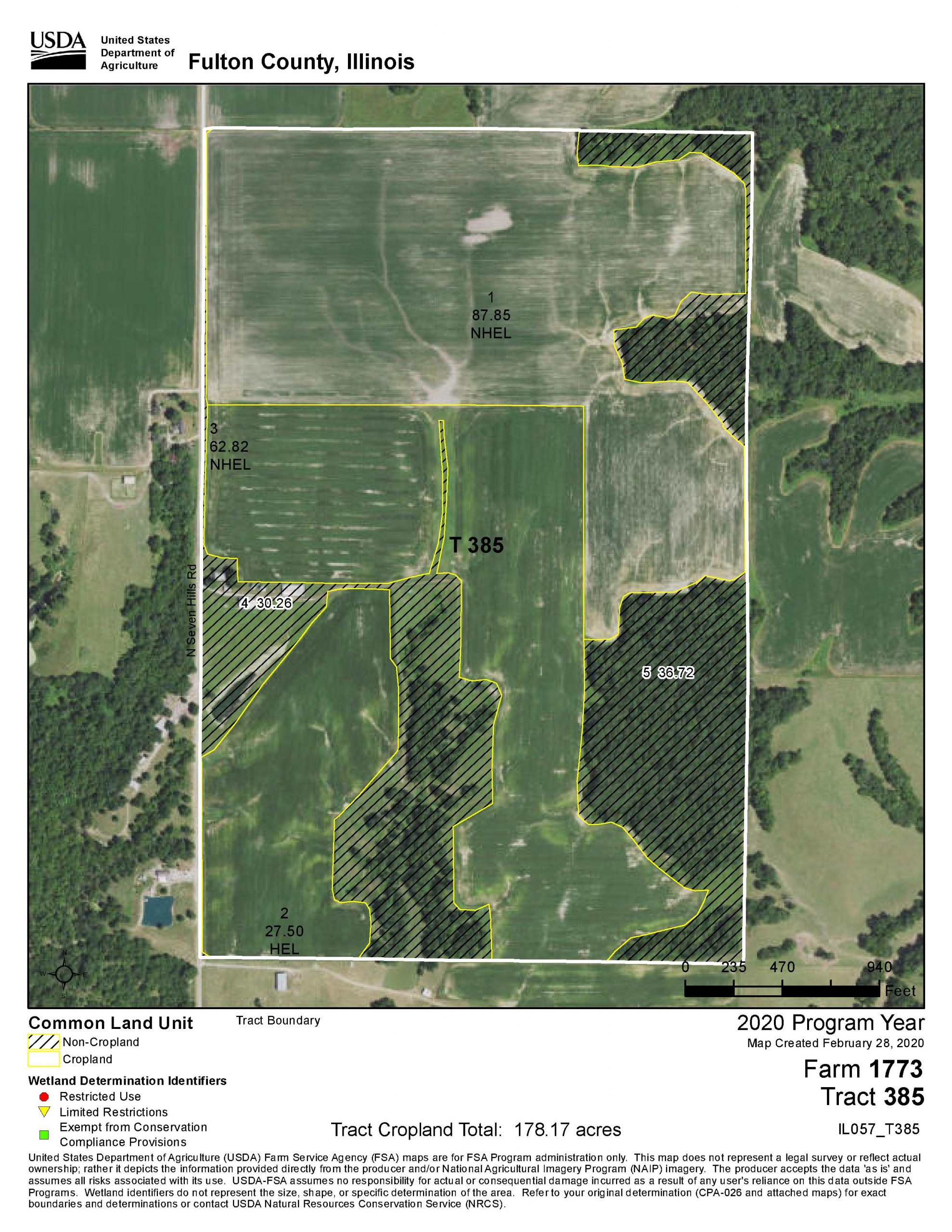

Fulton County Il Land Auction Westerfield Sullivan Auctioneers

Fulton Illinois Il 61252 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Fulton Illinois Il 61252 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Fulton County Farm Bureau Home Facebook

Fulton County Il Land Auction Westerfield Sullivan Auctioneers

Fulton County Il Land Auction Westerfield Sullivan Auctioneers

Fulton Giving Property Owners Until Aug 5 To Appeal Tax Assessments Neighbornewsonline Com Suburban Atlanta S Local Mdjonline Com

Land Values Accelerate Across West Central Illinois

Fulton County Illinois Land Auction Sullivan Auctioneers

Land Auction 246 58 Surveyed Acres 3 Tracts Productive Farmland Country Home Timber Grassland Fulton County Il Van Adkisson

Fulton County Small Business Covid 19 Relief Grant Fcsbg Now Available City Of Canton

Fulton County Il Land For Sale 43 Listings Landwatch

Fulton County Il Land Auction Ingersoll Sullivan Auctioneers

508 4th St Fulton Il 61252 Realtor Com

Fulton County Circuit Clerk S Office Home Facebook

Fulton County Treasurer Fulton County