a limited-pay life policy has quizlet

Which of the following is an example of a limited-pay life policy. A limited pay whole life policy is a permanent insurance policy guaranteed to be fully paid-up at a certain date or when you reach a certain age with no more premiums due.

Pin On Flight Attendant Interview Tips

Which of the following is an example of a limited-pay life policy.

. Renaissance and reformation test. In the event of death the loan amount is deducted from the policy proceeds b. In this case that 30 premium would not change for your whole life.

Once you reach the target years or age premiums are no longer required but the policys benefits lasts the insureds entire life. September 3 2020 by Brandon Roberts. However many times than not you want to give up your policy before its stipulated tenure.

Barry has purchased 300000 worth of term life insurance coverage for 20 years. Types Of Life Insurance Policies. Renewable Term to Age 100.

Renewable term to age 70. A straight life b life paid-up at age 65 c renewable term to age 70 d endowment maturing at age 65. Cash value still equals face amount at age 100 policy maturity Limited-Pay and Single-Premium Whole Life.

B The same as compared to the other payment modes. Life Paid-Up at Age 70. Which of these would be considered a Limited-Pay Life policy.

Premium payments limited to a specified number of years. As an optional policy rider. Common examples are plans that are fully paid for by age 65 or by age 85.

As a nonforfeiture option. Other whole life insurance policies like adjustable life insurance may increase or decrease premiums throughout the life of the plan. Limited-Pay and Single-Premium Whole Life.

He has instructed the company to apply the policy dividends to increase the death benefit. A policy owner has just borrowed from a life insurance policys cash value. When a term life policy matures the original premium payment agreement expires and now the policy owner must either pay a higher premium or find another life insurance policy.

A 20-Pay Life will be paid up in 20 years 20 PL Limited-Pay and Single-Premium Whole Life. After a number of years the policys cash value accumulates to 50000 and the face amount becomes 350000. A Limited pay life insurance policy has a set period in which you pay premiums into the policy either for a number of years or to a specific age.

Premiums on limited payment life insurance are paid for a limited number of years but the benefits last a lifetime. D More as compared to the other payment modes. 401 Russell Lowe has a life insurance policy that allows him to pay his premiums virtually at any time and virtually in any amount subject to certain minimums.

10-year Renewable and Convertible Term B. Limited Payment Whole Life Insurance. A life insurance policy is a long term contract.

Alternatively limited payment plans can be based on the insureds age. Life insurers offer various forms of term plans and traditional life policies as well as interest sensitive products which have become more prevalent since the 1980s. A Limited-Pay Life policy has.

Endowment maturing at age 65. Guaranteed cash value grows tax-deferred. Chapter 12 - Life Insurance 133.

A Limited-Pay Life policy has premium payments limited to a specified number of years 18 When is the face amount of a Whole Life policy paid. There is no set termwhole life policies build cash value over time and this cash value exists. Paid-up at 65 20-pay life 30-pay life Straight whole life.

A One-year term purchase. Ordinary whole life B. The policyowner chooses the annual mode for the payment of the life insurance premium.

A policyowner has a life insurance policy where she had listed her age on the application as 5 years younger than her actual age. The overwhelming majority of term life insurance policies issued today are level term policies. Increasing Term Life policy Nonparticipating policy Modified Whole Life policy Universal Life policy.

For the most part there are two types of life insurance plans - either term or permanent plans or some combination of the two. What kind of policy is this. For the year the owner will pay A More in the first policy year and then less in consequent years.

C Less as compared to the other payment modes. Which of these statements is true. The policy is intangible and pays a benefit either in case of maturity or death during the term of the plan.

Limited payment whole life insurance policies give lifetime protection but require only a limited number of premium payments such as for 10 or 20 years. Straight Whole Life D. Premiums are payable for 10 15 or 20 years depending on the policy selected.

Graded death benefits B. Life paid-up at age 65. Report an issue.

In most cases whole life policies pay a tax-free death benefit to beneficiaries when the insured dies. As a mandatory policy rider. No cash value C.

What type of insurance does Russell likely have. C Reduction of premiums. When the insured dies or at the policys maturity date whichever happens first 19 How long does the.

If purchased at age 30 paid up at age 50. The policy lapses if not repaid within 5 years c. June 24 2021.

He chose the Multiyear or Level term life insurance. Life Paid-Up at Age 70 C. Insurers offer several limited pay policies including.

An insured has a life insurance policy from a participating company and receives quarterly dividends. You can pay premiums monthly quarterly semi-annually or annually. Limited payment life C.

You buy the policy with a term ranging anywhere from 5 years to 35 years. For example you could have a 100000 straight life insurance policy for which you pay 30 a month. A policyowner must pre-qualify for the loan to determine creditworthiness.

What type of policy would offer a 40-year old the quickest accumulation of cash value. Metab 2 Final Review. A Limited-Pay Life policy has A.

B Accumulation at interest. A life policy with a death benefit that can fluctuate according to the performance of its underlying investment portfolio is referred to as. As a provision of the policy.

Limited-Pay and Single-Premium Whole Life. 9921 1033 PM examfx insurance Flashcards Quizlet Paid-up additions. Joe has a life insurance policy that has a face amount of 300000.

As an optional policy rider.

How To Spend The First Ten Minutes Of The Workday Ivanka Trump Leadership Management Leadership Career Advice

Man Was Arrested After Making A Bomb Joke Cebu City Jokes Cebu

Texture Worksheet High School Art Worksheets Art Worksheets Elementary Art Projects

/buffetts-road-to-riches-55e02ee845ff4203b0e9cb3117fa6710.png)

Warren Buffett S Investing Strategy An Inside Look

Level Premium Term Life Insurance Policies Quizlet At Level

Timeline Photos From The Mind Of Tim Burton Tim Burton Tim Burton Films Tim Burton Johnny Depp

Level Premium Term Life Insurance Policies Quizlet At Level

/laissez-faire-definition-4159781-V2-828107953ee443f1bdeaaaba9b35759b.jpg)

What Is Laissez Faire Economic Theory

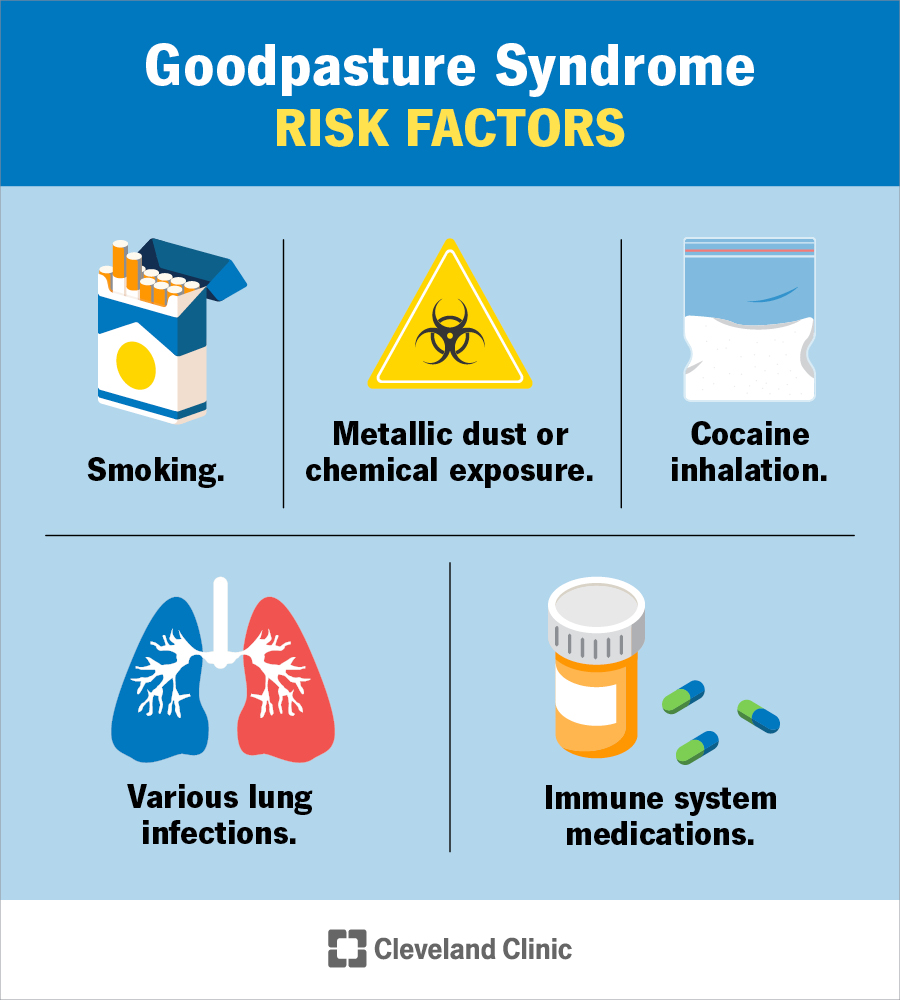

Goodpasture Syndrome Anti Gbm Disease What Is It Symptoms Treatment

Renters Insurance Quizlet Best Health Insurance Healthcare Plan Health Insurance Coverage

Pin On Support Equity Blm Lgbtq Human Rights Truth

Pin On Cardiovascular System Insight

Level Premium Term Life Insurance Policies Quizlet At Level

Simple Alphabet Chart That Contains Both Uppercase And Lowercase Letters Alphabet Charts Alphabet Recognition Uppercase And Lowercase Letters

Get Monthly Payday Loans Are The Great Aid For The Poor Creditor As They Get Rid Of Their Tension Of Fin Payday Loans Loans For Bad Credit Instant Payday Loans

Level Premium Term Life Insurance Policies Quizlet At Level

Level Premium Term Life Insurance Policies Quizlet At Level

Louisiana Purchase And Lewis And Clark Handout Louisiana Purchase Louisiana Purchase Activities Louisiana Purchase Map